Reporting

Reporting

PayFuture’s technology offers a full suite of reporting tools which can be customised to your business’s requirements, offering powerful reporting options for merchants and white label partners. If you wish to investigate a single transaction or try to find trends for an entire processor or multiple merchants, we offer real-time visibility into all of their transactions via our technology.

Reports are accessible via our back office and through a flexible reporting API. The reporting suite offers file transfer and the ability to download reports in csv format with configurable multi-user permission settings.

Back Office Insights and Analytics

Back Office Insights and Analytics

Payments are a complex space, but more so especially when it comes to the reconciliation process in a paymentsgateway/connector/aggregator environment. However, PayFuture has created a simple to use payment platform interface ensuring your business has detailed reporting functionality with just a few simple clicks. By offering payments data, insights and analysis we enable instantaneous and most importantly real time views of the sales transactions, payouts, reconciliation and settlements.

Load Balancing and Cascading

Load Balancing and Cascading

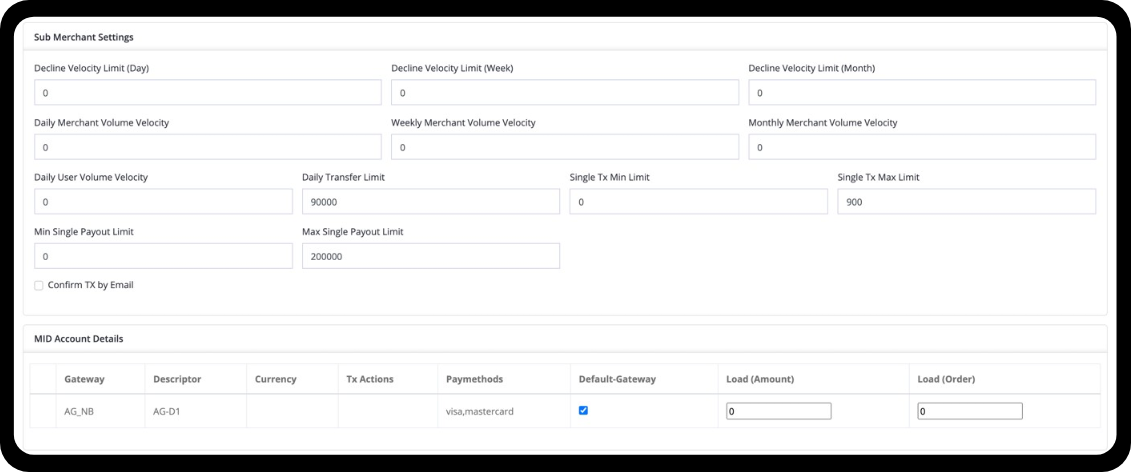

Our next generation payment gateway connector technology allows businesses to manage multiple payment methods seamlessly under one simple to use interface. The technology allows management of merchant accounts, multiple processor priorities and offers load balancing across multiple processors and merchants, all according to administrator defined properties.

Alerting

Alerting

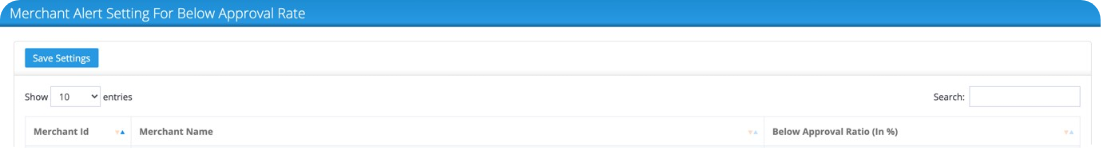

PayFuture has a unique Whatsapp, Telegram and Skype alerting system which will make the life of the transaction monitoring team so much easier. We can alert on various customisable parameters.

If any parameters defined by the admin user are triggered an instant alert is sent to all monitoring teams to notify them of any potential issues preventing service downtime and interruption. The alerts are also fully customisable but examples are:-

- If a processor is not seeing any attempted transactions for the last 3 minutes

- If a merchant is not getting any approvals

- If declines are above a certain percentage, seeing the productivity and returns from your technology platform investment.